GRI 3: Material Topics

a) Process to Determine Material Topics

The materiality analysis forms the basis of the Belimo sustainability strategy. Topics are deemed material if they have a significant impact on people, the economy, and the environment.

Belimo determines relevant topics by means of a materiality assessment according to three dimensions: strategic relevance for the business, impact on sustainable development, and relevance for key stakeholder groups of Belimo. By identifying these topics and implementing the following steps to address these material topics, Belimo aims to strengthen its stakeholder relationships, monitor high-level opportunities, safeguard against risks, and maintain its successful mid- and long-term growth performance.

An overview of the topics identified in the process, which started with an industry and peer evaluation and was developed in dialogue with Group management across the Company, is provided in the resulting materiality map. A detailed description of the process is disclosed in the Materiality Overview.

b) Stakeholders and Experts Involved in the Process of Determining Material Topics

Belimo uses a broad context analysis to identify a list of potentially relevant topics, taking into account industry-specific circumstances and studies, reporting standards, and customer, employee, and investor expectations.

The resulting materiality map was set up internally by experts from various disciplines. Based on the material topics, a sustainability strategy and goals have been successively defined, and the sustainability reporting has been developed. For several years, the Group has been receiving support from an external consulting firm that specializes in sustainability strategy and reporting.

Economic Topics

Economic Performance

Why Is Economic Performance Important?

Successful economic performance is crucial for Belimo, as it enables us to create healthy indoor air and improve comfort while using less energy, both now and into the future. Delivering more value to our customers creates a virtuous cycle, leading to greater demand for products and more sales, boosting productivity and profitability.

What Is New in Economic Performance in 2023?

Belimo pursued its long-term growth and investment strategy unwaveringly and successfully throughout 2023. Thanks to our highly engaged employees and a strong network of suppliers, we were able to master the year’s challenges exceptionally well. In line with the Group’s strategy, we welcomed almost 100 additional new talents during the year under review. To sustain our future business, we also invested CHF 76.0 million, equivalent to 8.9% of our net sales, in research and development.

The most significant challenges came from a demanding economic environment leading to a slowdown of business momentum in the construction industry. For additional information, see Direct Economic Value Generated and Distributed

How Is Economic Performance Managed?

Belimo places significant importance on developing its niche and maintaining market leadership. The Company is committed to solving customer issues and safeguarding against competition by maintaining its leading market position in innovation and quality. It does this by focusing on organic growth and outsourcing manufacturing and services to those with greater expertise or more efficient economies of scale. Sustaining economic performance involves optimal use of available resources, as well as balancing growth and profitability. Sharing investment allocations between different business lines relies on the following processes: strategic planning (long-term), budgeting (annual), forecasting (during the year), and controlling actual returns and costs (continuous).

How Is Economic Performance Measured?

We track the following key performance indicators to measure our success in economic performance:

Sales

- Market volume and share by market region and business line.

- Sales growth by market region and business line.

- Price analysis by market region and business line.

Profitability

- Contribution margin analysis by market region and business line.

- Earnings before interest and taxes and net income development at Group level.

- Operating expenses by group division.

Cash flow

- Cash flow from operating activities.

- Free cash flow.

- Cash effective investments in property, plant, and equipment as well as in intangible assets.

- Dividend distribution.

Optimal use of capital

- Return on invested capital.

- Return on equity.

- Equity-to-fixed-asset ratio.

- Inventory period.

Net sales grew 7.2% in local currencies and 1.4%, to CHF 858.8 million, in Swiss francs in 2023. Earnings before interest and taxes (EBIT) came to CHF 152.5 million in 2023 (2022: CHF 152.4 million). With an EBIT margin of 17.8% (2022: 18.0%), profitability was very robust. This is despite the demanding economic environment, inflation trends, and foreign exchange developments that were unfavorable for Belimo given that its main cost base is in Swiss francs. Material costs normalized after having increased in 2022, owing to supply disruptions, higher energy costs, and inflation.

The Group achieved net income of CHF 136.8 million (2022: CHF 122.7 million). Earnings per share rose to CHF 11.14 (2022: CHF 9.99). Both figures were positively impacted by a one-time tax effect of CHF 17.1 million in 2023 absorbing a negative financial result of CHF 10.1 million driven by strong adverse foreign currency movements during 2023.

Operating cash flow increased to CHF 157.0 million (2022: CHF 112.9 million), positively affected by a decline in net working capital in the reporting period. In previous year, net working capital has been increased to maintain superior lead times in an environment of global supply chain shortages. Free cash flow amounted to CHF 135.9 million (2022: CHF 91.2 million), including a divestment of term deposits of CHF 25.0 million (2022: net divestment of CHF 35.0 million).

The Board of Directors is proposing a dividend of CHF 8.50 per share at the 2024 Annual General Meeting on March 25, 2024. This is based on the closing price of CHF 463.80 on December 29, 2023, equivalent to a return of 1.8% per share.

Customer Engagement and Support

Why Is Customer Engagement and Support Important?

The use of digital tools in the planning, design, and execution of projects for building automation and control systems is becoming increasingly predominant and changing the pattern of physical interactions. Belimo is investing in this field to maintain its competitive advantage of excellent customer support that caters to the needs of a digitally adept generation of customers, and to ensure a strong emotional bond with them.

What Is New in Customer Engagement and Support in 2023?

Belimo continued to increase the level of interaction with its customers, through innovative digital initiatives and more personal touchpoints. To achieve this goal, the Company has evolved its e-commerce strategy, and continued to improve and enhance its website navigation, simplifying product selection in its online store to allow for more transparent order tracking. Belimo has also continued to optimize its cloud-based customer relationship management (CRM) system by introducing a ticketing workflow, computer telephony, and a global quoting tool. This will help to increase customer engagement and support, while making it more user friendly for employees and increasing both daily use and adoption rates. Moreover, Belimo has further increased the number of sales engineers in 2023 to 476 – from 442 in 2022 – to better support its customers in the field.

How Is Customer Engagement and Support Managed?

Belimo focuses on the following tools and assets to ensure the consistency of its customer engagement:

- Key to a great digital customer experience is the integration of all different data streams – be it customer-facing data, device data, or production data – and the connection of all these data pools in a meaningful way.

- A strong, local sales team that offers expert engineering advice in the customer’s language.

- A digital technical support service that allows customers to communicate easily with support engineers.

- A customer relationship management system that strives to integrate service, sales, technical support, and product and quality organization.

- A fully integrated and seamless global website with e-commerce.

- Efficient sizing, selection, and specification software paired with well-balanced training courses.

- Dedicated employees for continuous process improvement, training, quality assurance, and compliance with data protection regulations.

- Well-documented internal policies and procedures that help our employees to be aware of their responsibilities and of upstream and downstream value-creation processes.

How Is Customer Engagement and Support Measured?

To measure customer satisfaction, Belimo conducts customer surveys, tracks material returns, and has implemented a customer-issue tracking system to assess its effectiveness in resolving customer problems. A key performance indicator for tracking the success of our e-commerce is the percentage of sales through our website and other digital channels.

Partnership with Suppliers

Why Is Partnership with Suppliers Important?

Highly Externalized Production Costs

Belimo views its suppliers as key partners and the most critical element of its asset-light model (88% of production costs is outsourced, see graph on the left). They are critical to uphold the Company’s customer-oriented flexibility and deliver high-quality field devices that arrive on schedule. Especially in challenging times, these long-term partnerships are essential for high product availability.

Belimo suppliers are not only as providers of parts and assemblies, but key partners when developing specifications for products or services. They contribute significantly to the Company’s innovative capacity, as they help to fulfill end-users’ needs while cost-effectively meeting and exceeding mandates.

What Is New in Partnership with Suppliers in 2023?

Procurement by Region

There were many operational challenges during the year under review, including material shortages in specific categories, reduced transportation capacity, and increased costs of materials, services, and transportation.

A critical project to reduce risk and make our supply chain even more resilient was initiated in 2023, further improving our global supply chain strategy (see graph on procurement volume by region on the left). A new concept regarding supplier contracts has also been rolled out to foster mutual relationship with our suppliers. Furthermore, we increased our capacity for supplier audits in 2023 by hiring additional experts in this field, further supporting our 412 suppliers in their development.

How Is Partnership with Suppliers Managed?

The main instruments for establishing new supplier relationships, and for evaluating existing ones, are audits, risk management, and category management. Suppliers are expected to grant Belimo full transparency to enable risk assessment. This can mean access to relevant financial records or evidence of adherence to standards, such as Belimo quality standards or safety standards, as well as showcasing the individual supplier's ability, availability, and capacity to work on projects.

Belimo strives for an active partnership with its suppliers’ workforces, helping to develop their manufacturing processes to ensure long-term success. The ultimate ambition of the Company’s supply chain strategy is to engage suppliers that mirror its culture and match its growth and thus to establish relationships characterized by trust and honesty. Once a collaboration has been established, Belimo looks primarily for suppliers that experience healthy profits, as this demonstrates their capability to innovate and invest in state-of-the-art, environmentally friendly technologies.

We audit around 10% of our suppliers every year, focusing on A, B, and special part suppliers (they are categorized on the basis of procurement volumes and/or their strategic importance). We take on between one and five new suppliers each year who are then subjected to initial audits, while at the same time gradually screening out non-compliant ones. Approximately 60% of our purchasing volume is sourced from suppliers with whom we have worked with for more than twenty years. On average, we have maintained relationships of more than ten years’ standing with approximately two thirds of our suppliers.

How Is Partnership with Suppliers Measured?

To measure the success of how we manage the partnerships with our suppliers, we keep track of the following key performance indicators:

- Percentage of external production costs.

- Material expenses (including changes in inventories) in % of net sales.

- Threshold of Belimo sales for each supplier.

- Net sales per employee.

- Average duration of collaboration with a supplier.

- Number of supplier complaints (see Quality First).

- Number of audited suppliers per year (in % of total suppliers).

- Total number of suppliers.

- Procurement volume by main material groups.

- Procurement volume by region.

- Number of supplier-induced quality cases.

- Production cost ratios in final assembly, testing, and customization.

Process Efficiency and Short Lead Times

Why Is Process Efficiency and Short Lead Times Important?

Frequent last-minute changes in planning, construction, installation, and commissioning are a significant challenge in the HVAC industry. Therefore, our customers highly value short lead times and reliable, on-time delivery. Short lead times are a primary competitive advantage of Belimo that result from super-efficient handling of all downstream processes. The continuing trend of direct, just-in-time shipments to installation sites further eliminates our customers’ need to stock supplies and handle material, making them even more successful.

What is New in Process Efficiency and Short Lead Times in 2023?

During the period under review, Belimo continued to invest in logistics and customization capacities in its key locations in all three market regions.

Other projects in the period under review included:

- Implementation of the SAP Transportation Management module to continue improving the Company’s industry-leading agile and responsive supply chain with the shortest possible lead times.

- Evaluation of partners to increase order visibility throughout the entire transportation chain. This will allow customers, subsidiaries, and customization centers to improve the tracking of orders, from the point of dispatch until delivery at the final location.

- Continued analysis of long-term global logistics and the customization footprint requirements, with the support of a digital twin to help plan and modify operations.

- Continuation of lean initiatives to drive process efficiency and general operational improvements.

- Broadening and optimizing the transportation sourcing strategy to focus on end-to-end visibility (supplier qualification, rationalization, leverage, etc.).

- Calculation of the transportation-related GHG footprint in accordance with the GLEC (Global Logistics Emissions Council) framework and the development of a global emissions reduction roadmap.

Global Delivery Performance

In 2023, the level and frequency of shipping – both air and sea – almost recovered to pre-COVID-19 levels. However, inflation continues to be the defining challenge in most of our main markets. This provides an opportunity for the Company to once again prove its operational excellence, and return its on-time delivery performance to pre-pandemic levels.

The global “first confirmed”-delivery percentage in the year under review was 86.4%, below the five-year average before the pandemic, but above the 2022 rate of 78.6% (see graph on the left).

How Are Process Efficiency and Short Lead Times Managed?

High flexibility and efficient processes are the basis for short lead times. The Group’s set-up with nine customization centers around the world (see map below) allows for speedy deliveries because orders are adapted to local market needs, as close as possible to our customers. Customer proximity and process efficiency also minimize urgent international airfreight shipments and cut carbon emissions.

A holistic understanding of the supply chain is key for short lead times and efficient end-to-end processes. Belimo therefore strongly focuses on continuous and proactive process improvements. Another crucial factor is the Company’s far-sighted investment in logistics infrastructure, which has been continuously expanded over the last decade.

How Is Process Efficiency and Short Lead Times Measured?

Belimo tracks the following key performance indicators to gauge its global on-time delivery performance:

- First confirmed date: the delivery date initially promised after a customer places a sales order.

- Last confirmed date: the final confirmed date, adjusted to reflect an order that could not be fulfilled.

- On-time delivery of suppliers: the inbound delivery performance of distributors is tracked to help improve this aspect in the long run.

- Capacity and customer order backlog (open customer orders): this data is key for operational decision making and forms the basis for supplying transparent, reliable, and on-time information.

- Order cycle time: the process efficiency of all administrational and operational steps is measured to help identify possible task or project improvements.

Balanced Investment Portfolio

Why Is Balanced Investment Portfolio Important?

Managing the portfolio in the interest of the Company’s long-term success involves striking the right balance between investments in both existing and new portfolios. In its existing business, Belimo focuses on maintaining a broad, competitive, and differentiated product range and renewing selected sub-ranges at the end of their lifecycle. In its new business areas, Belimo aims to generate growth by developing unique and innovative products for existing customer groups. This will be, for example, through new sales approaches, extra marketing measures, or training.

What Is New in Balanced Investment Portfolio in 2023?

In the period under review, Belimo continued to expand its sales organization with Regional Application Specialists and Business Development Managers, who support our customers from the initial RetroFIT+ project assessment all the way through to successful completion. Meanwhile, under the Grow Asia Pacific initiative, the Company continued to expand its market presence in China and particularly in India by increasing its sales and marketing resources. To further drive the Digital Customer Experience initiative, BIM (Building Information Modeling) specialists were appointed in all significant subsidiaries. Regarding the fundamental renewal of the core platforms for Damper Actuators and Control Valves, the Company reached another milestone in the product development process and is on track to launch the platforms in the coming years. Within its Sensors and Meters initiative, Belimo released BACnet and Modbus-compatible room sensors and room operating units. Lastly, the Digital Ecosystem also continued to grow with new collaborators joining.

How Is Balanced Investment Portfolio Managed?

A comprehensive annual strategy ensures that Belimo will strike this desired balance. The Markets and Innovation Committee, a formal team that is comprised of senior Belimo executives from the three sales regions, Product Management, Group Innovation, and Group Strategy, assesses and prioritizes projects to be released for development.

How Is Balanced Investment Portfolio Measured?

The key performance indicators of the different initiatives are tracked and discussed each quarter by the Executive Committee and the individual initiative manager. These generally include indicators for the:

- Dedicated headcounts.

- Sales growth per strategic growth initiative.

A key performance indicator per initiative is, for example:

- The number of collaborations in the Belimo Digital Ecosystem.

The following key performance indicators are examples of important operative figures that enable balanced allocations between investments in the different areas of the Company:

- Percentage of sales spent on research and development.

- Percentage of sales spent on marketing.

- Percentage of sales spent on training.

- Incremental sales of new products in their fifth year since market launch divided by net sales.

Strategic IP Management

Why Is Strategic IP Management Important?

The primary reason for pursuing strategic intellectual property (IP) management is to ensure that both Belimo and its customers have the right to use products developed by the Company (freedom to operate). Secondly, deploying strategic IP management helps protect essential elements in the customer journey, as well as technological advantages and subsequent innovation leadership. Continuously assessing the value of IP rights and the optimal use of service providers ensures cost-effective operation.

What Is New in Strategic IP Management in 2023?

Intellectual Property Overview

Belimo filed a slightly lower number of new patent applications in 2023 compared to the previous year, further strengthening its IP portfolio. In total, 16 new patent families were created, increasing the number in active ownership to 134 patent families.

Belimo also strengthened its IP protection in the year under review, covering the entire customer journey to ensure that customer groups have the freedom to operate.

How Is Strategic IP Managed?

Our strategic IP management team continuously monitors ongoing development projects in the search for new patents, mapping out and analyzing their status in each business line. In addition, new application or technology patents in the HVAC industry are regularly monitored to ensure freedom to operate and to stay up to date with any advancements in the market. This approach allows developers to focus primarily on their own roles. IP management also includes defining rules and dividing the work between development partners before a project is started. These aspects are well-documented in development and non-disclosure agreements. If required, Belimo evaluates the licensing of advanced technologies for its products. Additionally, IP management maintains a patent database for tracking and sharing relevant information.

Strategic IP management is especially relevant in the age of digitization. Belimo puts significant effort into monitoring activities in this field, as it is increasingly competing with IT companies that file for a vast number of patents. This field is another vital intellectual property area and Belimo has already filed several patent applications.

How Is Strategic IP Management Measured?

We track the following key performance indicators to assess our performance regarding the management of IP:

- Patent families in active ownership.

- Newly created patent families.

- Number of cross-licensing agreements as an indicator of friendly relationships between Belimo and other companies, especially competitors.

- Total intellectual property related litigation cost in Swiss francs.

- Number of patents in the field of digitization.

- Quality of patents in relation to the mid- and long-term needs of the business lines and the Company strategy (a qualitative key performance indicator that is measured through the feedback from business line leaders).

Solution Leadership

Why Is Solution Leadership Important?

We strive for market and technological leadership. We invest substantially more than our competitors in innovation to surprise the market with unique solutions that offer more customer value in their applications. Our full attention is focused on heating, ventilation, and air-conditioning applications, with the mission to “Create Healthier Indoor Comfort with Less Energy.”

What is New in Solution Leadership in 2023?

Spending on Research and Development

Investment in research and development is vital for maintaining successful solution leadership. A key performance indicator for this is the resources dedicated to research and development as a percentage of net sales. This share has remained stable at a rate of more than 7% over the last five years, amounting to 8.9% in 2023 (see graph on the left).

One of the key achievements in solution leadership in the period under review was reaching another milestone in the fundamental renewal of the core platforms for the majority of Belimo field devices. The Company also increased the number of employees in its three dedicated innovation hubs – Danbury in the Americas, Großröhrsdorf in EMEA, and Shanghai in Asia Pacific – making its research and development activities more international.

How Is Solution Leadership Managed?

We generally refrain from investing in material assets and instead concentrate on developing our employees, products, markets, and quality standards. We diversify in depth rather than in breadth. We see innovation as one of the most critical factors for long-term success. The challenges of our customers and of new technology trends inspire us to develop groundbreaking solutions. During the product creation process, our customer-centric method CESIM® ensures that the project team never loses sight of the primary purpose and customer benefit of a product. As part of CESIM®, an array of customer segments, suppliers, and development partners become involved at an early stage. This allows us, together with our stakeholders, to find and verify innovative approaches and ideas.

How Is Solution Leadership Measured?

To gauge the success in solution leadership, we track the following key performance indicators:

- Resources dedicated to research and development as a percentage of net sales.

- Resources dedicated to research and development compared to competitors.

- Research and development investments in different segments compared to changes in sales or market share of the corresponding segments.

- Overall strategic development of the product range.

- The number of quality cases.

- Achievement of individual metrics at the dedicated stages, gates, and deliverables for every innovation project.

- Belimo maintains a “strategic products” reporting that tracks existing products’ sales and margin development for selected strategic, high-performance products. This report is sent to all managers and serves as a basis for management reviews.

Quality First

Why Is Quality First Important?

As the global market leader in HVAC field devices, we provide our customers with more value and deliver higher-quality products with comparatively longer warranty periods. All Belimo employees are encouraged to assume their share of responsibility for safeguarding our Quality First standards.

What Is New in Quality First in 2023?

The Company’s quality strategy and organization were further strengthened during the reporting period, with a concentration on scaling and streamlining global processes to support continued growth and increase transparency. Similarly, a globally uniform audit tool was introduced, which allows for easier tracking and sharing of results and key learnings. The management of product and operational requirements has been another area of focus, and a compliance expert role was created to support this. Furthermore, supplier quality engineering has been added to the product creation process to improve quality-related planning. The number of customer, supplier, and internal complaints in 2023 in each category in relation to net sales compared to the previous years is shown below:

Supplier Complaints

Customer Complaints

Internal Complaints

How Is Quality First Managed?

We achieve the highest quality by sharing responsibility between all employees and are enforcing the quality first standard through workshops in all divisions. This ensures that everyone in the Company becomes an intrinsic part of the development cycle and, by raising awareness among our employees, we commit to living up to the strict quality standards that we have pledged. Belimo employees are encouraged to constantly seek new ways to improve operational excellence at every step of the value chain. If issues are discovered, an online form can be used to open an internal quality, environmental, or safety case. The input from these forms is analyzed and suitable action is subsequently taken.

How Is Quality First Measured?

We track several key performance indicators to evaluate the success of our Quality First approach, including:

- Total and relative number of supplier complaints.

- Total and relative number of customer complaints.

- Total and relative number of internal complaints.

- Total warranty expenses in CHF 1’000.

- Number of return merchandise authorizations (RMA).

Environmental Topics

Energy Efficiency in Operations

Why Is Energy Efficiency in Operations Important?

As Belimo stands for energy-efficient HVAC field devices, its stakeholders expect the Company to run energy-efficient operations. With this in mind, Belimo focuses its efforts on reducing its environmental footprint where it considers itself most qualified and where it achieves the most significant impact – in its very own buildings.

What Is New in Energy Efficiency in Operations in 2023?

Energy Consumption Overview

The trend towards adopting renewable energy sources continued in 2023, accounting for as much as 54% of total energy consumption (see graph on the left). To put this number into perspective: the two main Belimo sites – Danbury, Connecticut, USA and Hinwil, Switzerland – accounted for approximately 80% of total energy consumption.

Photovoltaic installations at various Belimo sites already contributed 11.1% or 1'029 megawatt hours (MWh) to total energy consumption, which is included in renewable electricity in the graph on the left:

|

Energy Production at Belimo in MWh |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

Photovoltaic electricity production |

|

1'029 |

|

828 |

|

1'075 |

|

373 |

Regarding GHG emissions in scope 1 and 2, the Company’s reduction target is to achieve an 80% reduction of GHG emissions in its two main sites Hinwil and Danbury by 2025 (compared to 2019, see center graph below).

GHG Intensity

Scope 1 and 2

GHG Emissions

Scope 1 and 2

GHG Emissions

by Source

To achieve this reduction goal, Belimo has continued to drive technical, organizational, and behavioral energy-saving measures during the reporting period, which include, among others:

- Technical measures such as upgrading or replacing HVAC systems to more energy-efficient solutions at our Hinwil and Danbury sites, upgrading to modern LED lights, and installing electricity meters to allow more clarity where further savings could be achieved.

- Organizational measures such as the switch to renewable electricity.

- Behavioral measures are entered around an internal communications campaign to highlight every employee's contribution in response to the energy crisis in early 2023.

Combined, these initiatives led to an additional 5.8% reduction of GHG emissions in Belimo-owned buildings compared to 2022 (overall reduction of 50.4% compared to 2019). GHG intensity – measured in tCO2e per CHF 100 million of net sales – has meanwhile decreased once again in 2023 due to more renewable electricity sources and the sales growth.

Emissions from Scope 3: Business Travel

Meanwhile, emissions from scope 3, business travel, increased to 315.7 tCO2e of emissions per CHF 100 million of net sales:

|

Business Travel 1) |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

Emissions caused by air travel of employees in tCO 2 e per CHF 100 million of net sales |

|

315.7 |

|

211.9 |

|

64.3 |

|

79.2 |

1) Disclosure includes employees of the sites Danbury (CT, USA) and Hinwil (Switzerland).

How Is Energy Efficiency in Operations Managed?

Belimo relies on its building management system that allows the Company to display, supervise, and collect data from its major sites. This ensures its premises are managed in the best possible manner and achieves transparency as to where all the different forms of energy are being used, including energy demand, recycling, and waste. The collection of this data therefore paves the way for the introduction of tailor-made, local energy-saving measures. Belimo also strives to continuously improve energy consumption and reduce waste in production in accordance with lean management principles by continually analyzing the energy used in production processes at its sites.

How Is Energy Efficiency in Operations Measured?

Belimo tracks the following key performance indicators to gauge the success of managing energy efficiency in operations:

- Number of ISO 14001, ISO 9001, and ISO 45001-certified Belimo sites.

- Passed audits by the Swiss Association for Quality and Management Systems (SQS) and the China Quality Certification Center (CQC) in China.

- Percentage of modern LED lighting in Belimo facilities.

- Energy sources (renewable/non-renewable).

- Total energy costs in CHF and energy costs in percent of net sales.

In-house energy production:

- Installed Megawatt Peak (MWP) of photo-voltaic installations and its share of total energy consumption in Megawatt hours (MWh).

tCO2e of emissions:

- Direct from owned or controlled sources – scope 1.

- Indirect from the generation of purchased energy – scope 2.

- Caused by air travel by employees – part of scope 3.

Energy and GHG intensity:

- Total energy consumption and GHG emissions per CHF 100 million of net sales.

- kWh and kgCO2e per CHF 1’000 of net sales, per employee, and per actuator sold.

Recycling and disposal:

- Metric tons for recycling, incineration, and hazardous waste (electronics and separated materials).

- Cubic meters of wastewater.

Scope: Danbury and Hinwil; encompassing approximately 80% of total energy consumption within Belimo

|

Energy Consumption by Source in MWh (Scope 1 and 2) 1) |

|

Danbury (CT, USA) |

|

Hinwil (Switzerland) |

|

Total |

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

Electricity, non-renewable (purchased) |

|

1'891 |

|

- |

|

1'891 |

|

Electricity, renewable (purchased and in-house production) |

|

2'121 |

|

2'921 |

|

5'042 |

|

Natural gas |

|

1'275 |

|

- |

|

1'275 |

|

District heating |

|

- |

|

1'026 |

|

1'026 |

|

Diesel |

|

29 |

|

- |

|

29 |

|

Total |

|

5'315 |

|

3'946 |

|

9'261 |

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

Electricity, non-renewable (purchased) |

|

1'944 |

|

- |

|

1'944 |

|

Electricity, renewable (purchased and in-house production) |

|

2'005 |

|

3'330 |

|

5'336 |

|

Natural gas |

|

1'407 |

|

- |

|

1'407 |

|

District heating |

|

- |

|

1'003 |

|

1'003 |

|

Diesel |

|

51 |

|

- |

|

51 |

|

Total |

|

5'407 |

|

4'333 |

|

9'741 |

1) Disclosure includes data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

|

Floor Area in m 2 1) |

|

Danbury (CT, USA) |

|

Hinwil (Switzerland) |

|

Total |

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

Floor area of all buildings on site |

|

20'493 |

|

35'360 |

|

55'853 |

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

Floor area of all buildings on site |

|

18'263 |

|

35'360 |

|

53'623 |

1) Disclosure includes data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

|

Recycling and disposal in metric tons (unless indicated otherwise) 1) |

|

Danbury (CT, USA) |

|

Hinwil (Switzerland) |

|

Total |

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

Recycling |

|

362 |

|

295 |

|

657 |

|

Incineration |

|

95 |

|

161 |

|

255 |

|

Hazardous waste (electronics, separated materials) |

|

0 |

|

1 |

|

1 |

|

Wastewater, in m 3 |

|

3'854 |

|

6'266 |

|

10'120 |

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

Recycling |

|

358 |

|

433 |

|

791 |

|

Incineration |

|

77 |

|

184 |

|

261 |

|

Hazardous waste (electronics, separated materials) |

|

- |

|

2 |

|

2 |

|

Wastewater, in m3 |

|

6'500 |

|

6'212 |

|

12'712 |

1) Disclosure includes data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

|

Energy Intensity in kWh (Scope 1 and 2) 1) |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

Energy intensity per CHF 1'000 Group net sales |

|

10.78 |

|

11.50 |

|

Energy intensity per employee (average FTEs) |

|

4'171.43 |

|

4'762.87 |

|

Energy intensity per actuator sold |

|

1.27 |

|

1.22 |

1) Disclosure includes energy data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

High-Performance Solutions for Energy Efficiency and Indoor Air Quality

Why Is High-Performance Solutions for Energy Efficiency and Indoor Air Quality Important?

To quantify the energy leverage of its field devices and assess their impact over the entire lifecycle of a typical HVAC system, Belimo established an impact model in 2019. This allows us to better understand where energy optimizations in our value chain have the strongest leverage.

What Is New in High-Performance Solutions for Energy Efficiency and Indoor Air Quality in 2023?

The Company’s field devices once again contributed to avoiding 7.7 million tons of CO2e in 2023, calculated by the average savings of an air-side and a water-side actuator multiplied by the number of units shipped.

How Is High-Performance Solutions for Energy Efficiency and Indoor Air Quality Managed?

Belimo has structured its energy-impact model along six lifecycle steps:

- Resources: The model considers “gray” energy content included in materials used to build a typical field device (steel, copper, aluminum, plastics, electronics, and cardboard).

- Manufacturing: Also considered in our model is the energy needed to manufacture, assemble, and test the field devices.

- Distribution: The model considers the average amount of transportation energy needed to deliver a Belimo field device to the customer.

- Operation: The model then calculates the energy a Belimo field device uses during operation, taking into account the energy used in standby mode and when it is actuated.

- Energy Savings in HVAC Application: Even though typical HVAC systems operate much the same way around the world, significant variations arise due to differences between climate zones and power generation. Annual energy savings are therefore calculated based on the consumption of a typical HVAC system that operates with a global average heating and cooling load profile and with typical electrical power consumption.

- Recycling: Belimo strives to minimize waste generated at the end of life of its products. This often coincides with the end of life of an entire HVAC system and is difficult to manage and track.

How Is High-Performance Solutions for Energy Efficiency and Indoor Air Quality Measured?

To quantify our impact, the following levers and assumptions are key:

- The assumed lifetime: In our model, a conservative service life of 15 years is assumed. The actual lifetime is often 20 years or longer, made possible by the high quality and reliability of components used in Belimo actuators.

- The total leverage: The ratio of the energy-saving impact of a Belimo device in the field compared to all input factors. For air-side field devices, this ratio is 21 and for water-side field devices 31, with a weighted average of 24.

- The weighted CO2 impact of an air-side and water-side actuator: This figure (-1’103 kg CO2e) multiplied by the number of actuators shipped per year equals the total avoided tCO2e emissions of Belimo field devices.

- The applicable efficiency class of Belimo devices: Each efficiency class stipulated by EN ISO 52120-1:2022 exhibits a different energy savings factor during operation, ranging from 55% (A types) to 29% savings (C types). For its field devices, Belimo assumes a distribution of 30% A types, 60% B types, and 10% C types.

|

GHG Emission by Source in tCO 2 e (Scope 1 and 2) 1) |

|

Danbury (CT, USA) |

|

Hinwil (Switzerland) |

|

Total |

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

Electricity, market-based |

|

501 |

|

- |

|

501 |

|

Natural gas |

|

257 |

|

- |

|

257 |

|

Diesel |

|

8 |

|

- |

|

8 |

|

Total |

|

766 |

|

- |

|

766 |

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

Electricity, market-based |

|

515 |

|

- |

|

515 |

|

Natural gas |

|

284 |

|

- |

|

284 |

|

Diesel |

|

14 |

|

- |

|

14 |

|

Total |

|

813 |

|

- |

|

813 |

1) Disclosure includes data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

Calculation of emissions: Danbury 2022 and 2023 according to US EPA and Ecoinvent version 2.2. Hinwil 2022 and 2023 electricity purchased from European hydropower according to ”Leitfaden Stromkennzeichnung des Bundesamtes für Energie (BFE)”.

|

GHG Emission by Scope in tCO 2 e 1) |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

Scope 1: Direct emissions from owned or controlled sources |

|

265 |

|

298 |

|

Scope 2 - market-based: Indirect emissions from the generation of purchased energy |

|

501 |

|

515 |

|

Total |

|

766 |

|

813 |

1) Disclosure includes data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

|

GHG Emissions Intensity in kgCO 2 e (Scope 1 and 2) 1) |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

GHG emissions intensity per CHF 1'000 Group net sales |

|

0.89 |

|

0.96 |

|

GHG emissions intensity per employee (average FTEs) |

|

345.05 |

|

397.49 |

|

GHG emissions intensity per actuator sold |

|

0.10 |

|

0.10 |

1) Disclosure includes emission data for the sites in Danbury (CT, USA) and in Hinwil (Switzerland).

Digitally Enabled Solutions

Why Is Digitally Enabled Solutions Important?

By providing simple and secure access to our digital ecosystem, we help our customers digitize their energy- and comfort-optimizing solutions and maximize the value of their installations. Efficient digitally supported workflows and quality checks create transparency and actionable insights that allow them to deliver more reliable solutions than ever. At the same time, data helps Belimo to understand changes in the device usage of the specific building and application trends, ensuring its field devices remain relevant and continue to provide value for its customers and theirs. Furthermore, supporting common network platforms and providing edge logic and valuable data are strong points of differentiation and a source of additional growth for the Company.

What Is New in Digitally Enabled Solutions in 2023?

During the period under review, the Belimo Digital Ecosystem improved in four areas:

- Intelligence: Enhancing the firmware that enables the intelligence of HVAC applications – such as demand-controlled ventilation – that runs on each of our digital devices.

- Integration: Enabling communication between our devices and other digital agents such as Building Automation and Control Systems and Building Internet of Things solutions.

- Interaction: Facilitating interactions between installers and our field devices through the Belimo Assistant App.

- Insight: Enabling valuable insights by integrating our field devices’ digital twin.

The growth of the Belimo Digital Ecosystem and its applications during the reporting period is reflected by the increasing number of collaborators, which is currently at 30. To ensure the scalability of the Belimo Digital Ecosystem, all of the Company’s devices are modular and standardized, which has many advantages. For example, standardizing the interfaces of our field devices makes it easier to comprehend their digital offerings, which helps users to take full advantage of all features.

How Is Digitally Enabled Solutions Managed?

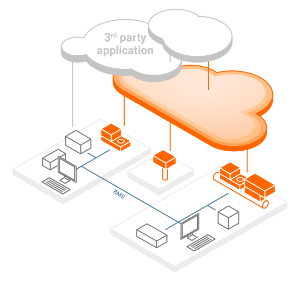

The digital ecosystem enables the means to offer flexible and seamlessly available system integration and high-quality device data.

Belimo continues to increase the number of network- and cloud-capable devices that it offers and the number of devices that generate their own digital twins. Customers who own a Belimo Internet of Things device also own its digital twin and the data it collects. They can interact with it through the Belimo Cloud or an application program interface – which can be made of use by third-party applications – and aggregate the data collected by Belimo devices for a holistic building overview.

Subject matter experts are focused on this topic, ensuring the Company remains the global leader in HVAC systems. It is crucial not only to offer the best products in traditional uses, but also to become a digital enabler of HVAC applications. For this purpose, Belimo supports all popular technologies and protocols and keeps pace with market trends.

How Is Digitally Enabled Solutions Measured?

We track the following key performance indicators to help measure the success of our management performance with respect to digitally enabled solutions:

- The number of external companies integrating the Belimo digital ecosystem in their solutions.

- The number of field devices that synchronized with their digital twin at least once in operation.

- The increase in sales of connected devices.

Environmental Footprint of the Supply Chain

Why Is the Environmental Footprint of the Supply Chain Important?

Upstream suppliers are mission critical to the business model, the sustainability mission, and the Quality First values at Belimo. While pollution impacts the environment and violates our ethical standards, resource efficiency and waste reduction lower costs, which is another reason why we go to great lengths to minimize the environmental impact of our upstream supply chain.

What Is New in Environmental Footprint of the Supply Chain in 2023?

Belimo continued to implement its new global supply chain strategy in the period under review, centered around a key project focusing on the reduction of GHG along its entire supply chain. Also in 2023, Belimo was able to increase purchasing volumes with ISO 14001 and 9001 certified suppliers, reaching current volumes of 74% and 89%, respectively (see graph on the left below). Belimo also started tracking the coverage with occupational health and safety management systems – certified to ISO 45001:2018 – in its supply chain.

ISO-Certified Suppliers

EcoVadis Silver Medal

Belimo was again awarded a silver medal by EcoVadis in 2023, with an overall score of 60/100, in recognition of its sustainability achievements. In 2023, the Company shared its EcoVadis scorecard a total of 51 times, which leads of a total of 77 shared EcoVadis scorecards. Almost all companies involved in procurement have signed the Belimo Supplier Principles, which prohibit gross violations of environmental laws. All A-suppliers have signed the principles, and only suppliers with small to medium-sized volumes did not sign.

How Is the Environmental Footprint of the Supply Chain Managed?

When it comes to ecological, social, and government standards, we make the same demands of our suppliers as we do of our internal service providers. Our sustainability and social responsibility principles regarding suppliers are set out in the Belimo Supply Chain Policy. All suppliers are expected to sign the Belimo Supplier Principles, to comply, and to demand conformity from their sub-suppliers as well. Due diligence helps to mitigate the risks from flawed supplier practices. Contract management is one instrument for holding third parties accountable, and both selected new and existing suppliers must undergo regular process audits, during which we verify their adherence to the Belimo Supplier Principles.

How Is the Environmental Footprint of the Supply Chain Measured?

To gauge the success of managing the environmental footprint of the supply chain, we adduce the following key performance indicators:

- Procurement volume from Belimo Supplier Principles signatories (in % of total procurement volume).

- Procurement volume from ISO 14001, ISO 9001, and ISO 45001-certified suppliers (in % of total procurement volume).

- Number of shared EcoVadis scorecards and our overall EcoVadis score.

Belimo strives to avoid the use of materials that place an unnecessary strain on the environment and are difficult to discard. It is our goal to avoid the use of critical substances that pose a risk to the environment and to people's health and safety.

The Group Quality & Sustainability organization is responsible for product compliance with guidelines and regulations that govern the use of critical substances and conflict minerals in our products. These guidelines and regulations address the requirements of EU-RoHS, EU-REACH including reporting to ECHA's SCIP database, California Prop 65, Conflict Minerals reporting, amongst others. The ever-increasing volume of requirements that govern the industry is continuously analyzed, and the findings flow into processes and products. Regulations of banned or reportable substances are covered in the Belimo list of hazardous substances, which is an integral part of the supplier agreement provided to the suppliers, and with which suppliers must ensure compliance.

Belimo also relies on industry-accepted tools, such as FMEA (Failure Mode and Effect Analysis), and an in-depth risk analysis during the design process. Furthermore, all Belimo products undergo first-article inspection and series testing before distribution.

Legal and compliance matters concerning customer health and safety are listed in the Belimo requirement specifications. The Group is not aware of any health and safety incidents of its products. It is therefore considered that the Belimo requirement specifications are appropriate and are complied with.

Social Topics

Employee Empowerment and Engagement

Why Is Employee Empowerment and Engagement Important?

Belimo sees the engagement of its employees as a competitive advantage and believes that employee satisfaction leads directly to customer happiness. An empowered and engaged workforce is essential to market success, as it maintains a high level of customer support and innovative leadership. Employees are empowered through a high level of autonomy and responsibility in the decision-making processes for their specific organizational tasks.

What Is New in Employee Empowerment and Engagement in 2023?

Employee Engagement

The employee engagement score is a pivotal key performance indicator for gauging staff commitment, which is obtained through a survey conducted every three years. It achieved an outstanding score of 8.9 (see graph on the left) in the period under review, with an excellent participation rate of 90% (1’978 out of 2’198 employees), further demonstrating the high level of employee commitment.

Another key performance indicator in assessing employee engagement is staff turnover, which averaged 8.0% in 2023, down from 8.4% in 2022.

In the 2023 survey, employees were asked questions anonymously on central workplace subjects, including job content, structures, processes, collaboration, the Executive Committee, dealing with change, line managers, employee promotion, and remuneration. The subject areas that achieved the highest agreement overall at 8.9 included:

- Team collaboration, which reflects a good feedback culture through helping each other when work is difficult, as well as being able to speak one’s mind freely and openly express criticism.

- Customer orientation, focusing on customer-oriented behavior, and placing the upmost importance on knowing their needs and expectations, which is one of our values.

- Direct manager and supervisors, including attributes such as openness, honesty, and living company values.

How Is Employee Empowerment and Engagement Managed?

For Belimo, Employee Empowerment and Engagement begins with transparent communication and a culture of trust. Creating a trusting work environment, where employees can thrive and unleash their full potential, is a primary aspiration of our Company. Belimo regularly conducts management training on its corporate mission and values to ensure that employees remain empowered and engaged. Managers are trained to foster participation in a trial-and-error culture and to align their decision-making process with the mission and values of Belimo. It is an essential responsibility of managers across all levels to act as role models, to represent the values of the Company, and to lead by example. Belimo also regularly supports social and team-building events.

How Is Employee Empowerment and Engagement Measured?

Key performance indicators closely linked to Employee Empowerment and Engagement are engagement scores, employee tenure, turnover, and absenteeism rates. Currently, we report the engagement score and global employee turnover rates. We plan however to add global tenure to our reporting in the future.

Engagement Score

- The leading indicator for assessing employee engagement is the “engagement score.” It is obtained through a group-wide employee survey conducted every three years. Employees are polled anonymously regarding central workplace subjects and individual teams analyze the results to implement corrective measures.

Employee Tenure

- The amount of time an employee has been employed by Belimo or the average amount of time that all current employees have been employed by the Company.

Employee Turnover

- Belimo defines employee turnover as terminations by employees (all reasons) or by the Company (inadequate performance), not including departures of apprentices or temporary employees, retirements, deaths, or terminations by the employer due to economic reasons.

|

New Hires (Headcount) |

|

Danbury (CT, USA) |

|

Hinwil (Switzerland) |

|

Other locations |

|

Total |

|

Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

25 |

|

41 |

|

50 |

|

116 |

|

33.0% |

|

Male |

|

57 |

|

86 |

|

93 |

|

236 |

|

67.0% |

|

Total |

|

82 |

|

127 |

|

143 |

|

352 |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

< 30 years |

|

30 |

|

32 |

|

41 |

|

103 |

|

29.3% |

|

30 ‒ 50 years |

|

38 |

|

75 |

|

89 |

|

202 |

|

57.4% |

|

> 50 years |

|

14 |

|

20 |

|

13 |

|

47 |

|

13.4% |

|

Total |

|

82 |

|

127 |

|

143 |

|

352 |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

58 |

|

100 |

|

71 |

|

229 |

|

45.3% |

|

Male |

|

74 |

|

91 |

|

111 |

|

276 |

|

54.7% |

|

Total |

|

132 |

|

191 |

|

182 |

|

505 |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

< 30 years |

|

57 |

|

63 |

|

46 |

|

166 |

|

32.9% |

|

30 ‒ 50 years |

|

58 |

|

103 |

|

113 |

|

274 |

|

54.3% |

|

> 50 years |

|

17 |

|

25 |

|

23 |

|

65 |

|

12.9% |

|

Total |

|

132 |

|

191 |

|

182 |

|

505 |

|

100.0% |

|

Employee Turnover (Headcount) |

|

Danbury (CT, USA) |

|

Hinwil (Switzerland) |

|

Other locations |

|

Total |

|

Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

22 |

|

22 |

|

28 |

|

72 |

|

39.1% |

|

Male |

|

37 |

|

35 |

|

40 |

|

112 |

|

60.9% |

|

Total |

|

59 |

|

57 |

|

68 |

|

184 |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

< 30 years |

|

22 |

|

14 |

|

11 |

|

47 |

|

25.5% |

|

30 ‒ 50 years |

|

18 |

|

31 |

|

48 |

|

97 |

|

52.7% |

|

> 50 years |

|

19 |

|

12 |

|

9 |

|

40 |

|

21.7% |

|

Total |

|

59 |

|

57 |

|

68 |

|

184 |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

Female |

|

23 |

|

29 |

|

27 |

|

79 |

|

43.9% |

|

Male |

|

22 |

|

37 |

|

42 |

|

101 |

|

56.1% |

|

Total |

|

45 |

|

66 |

|

69 |

|

180 |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

< 30 years |

|

15 |

|

7 |

|

12 |

|

34 |

|

18.9% |

|

30 ‒ 50 years |

|

17 |

|

45 |

|

49 |

|

111 |

|

61.7% |

|

> 50 years |

|

13 |

|

14 |

|

8 |

|

35 |

|

19.4% |

|

Total |

|

45 |

|

66 |

|

69 |

|

180 |

|

100.0% |

The safety of our employees is of the highest priority for Belimo. A safe and healthy work environment not only safeguards our employees from accidents and injuries, but it also enhances the well-being and the morale at the workplace. In addition to that, not only our employees are protected, but the secure workplace also contributes to long-term organizational success and sustainability.

To improve on our safety culture and enhance the well-being of our employees, Belimo has decided to implement an ISO 45001 Management System on a group level. The integration of ISO 45001 into our current ISO 9001 and ISO 14001 Management System will mean that we will build a robust framework for hazard identification, risk assessment, and control measures, as well as promoting employee involvement and compliance.

A vital way to measure our success in safety and security is setting and measuring goals and targets. One of these targets is the Lost-Time Incident Frequency Rate (LTIFR). The LTIFR reflects the number of incidents that resulted in lost workdays per two hundred thousand hours worked. By tracking our performance on LTIFR, we get an indication of the safety of our work environment. It also enables us to compare our performance with the performance of companies with a similar risk level.

Belimo actively wants to improve on its LTIFR performance and thus demonstrate our commitment to prioritizing the health and safety of our employees. In addition to that, improving on LTIFR performance will also lead to an increase in productivity and efficiency.

Looking at the LTIFR for 2023, we unfortunately see an increase in our LTIFR. Therefore, it is vital for us that we improve in this field. Improving LTIFR is not just a statistical goal for us; it is a commitment to the well-being of our employees. A safe work environment safeguards our employees and promotes productivity, satisfaction, and the overall success of our company.

|

Lost-Time Incident Frequency Rate (per 200'000 working hours) 1) |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

Lost-time incident frequency rate |

|

3.05 |

|

2.42 |

1) Disclosure includes data for all P, L/C sites (excl. BELIMO Sensors Inc., Dorval and BEREVA S.r.l., Ora)

Skill Development and Knowledge Management

Why Is Skill Development and Knowledge Management Important?

Knowledgeable and properly trained employees are critical for providing customer value, operational excellence, and solution leadership. Belimo supports its employees in developing individual specialist expertise. Acquiring the necessary knowledge ensures that they are fully proficient in their tasks and responsibilities. Effectively managing skill development and knowledge also supports our whole workforce in its continuous life-long learning journey.

What Is New in Skill Development and Knowledge Management in 2023?

To further develop skills and knowledge, Belimo has introduced new online and instructor-led programs to provide blended learning environments for employees. Following the success of the Leadership by Personality workshop in 2022 – a three-day course aimed at managers, with a focus on Company values, strategies, and leadership – an additional workshop is currently being designed for 2024, which will focus on company culture.

The Belimo Leadership Accelerator program launched in 2021, combining internal workshops with an external training program, continued in 2023 with four individuals from the three market regions. The program helps participants to further develop their leadership skills, while providing Belimo with a pipeline of internal candidates for leadership roles:

|

Development of the Belimo Leadership Accelerator |

|

2023 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

Belimo Leadership Accelerator participants per year |

|

4 |

|

4 |

|

8 |

|

|

|

|

|

|

|

|

How Is Skill Development and Knowledge Management Managed?

Deliberate management of skill development ensures employees receive the training necessary for succeeding in their roles. Belimo deploys a global training organization with local teams to streamline its educational functions for customers and employees. The Company also provides e-learning content to employees and enables tracking of training and certifications.

Belimo works at all levels with performance and behavioral appraisal systems. These include regular status reports on the achievement of individual goals and employee performance. Personal development planning is outlined and discussed at regular employee reviews, while comprehensive global and local induction programs ensure that new employees are efficiently onboarded and fully grasp their work and the corporate culture at Belimo.

Employee personal development is strongly supported, and Belimo managers regularly complete training courses on leadership skills. All managers complete our three-day “Leadership by Personality” course. This course is conducted in all three market regions and focuses on our Company values, culture, and strategy as well as on the enhancement of leadership skills.

Belimo offers career path planning for managers and specialists and provides financial support for further individual education. Courses for improving employee skills and helping them in their careers include:

- Methodical Competency: Methodical experience includes general knowledge with cross-discipline importance. It comprises the ability to apply the specific learning and working methods necessary for the acquisition and development of expertise. Belimo offers a wide range of courses for developing such abilities, for example, presentation skills, project management, workshop leadership and moderation, introduction to HVAC and building technology, etc.

- Social Competency: Social competencies are key for succeeding in the working environment, as social skills are the basis for working together smoothly. These include fostering empathy, teamwork, and communication readiness. Courses offered to employees cover, for example, effective communication, negotiation and conflict management, intercultural competences, and language classes.

- Leadership Skills: Belimo understands leadership skills as the abilities of individuals to help oversee processes, to guide initiatives and projects, and to steer their team members towards the achievement of goals and customer expectations. In addition to the global leadership course “Leadership by Personality,” which is scheduled at regular intervals, other offerings include, for example, the essence of leadership, succeeding as a supervisor, change management, health promotion, or “The Seven Habits of Highly Effective People.”

- Code of Conduct: As a binding guideline for legally compliant and ethically responsible conduct, the Code of Conduct and the anti-bribery and anti-corruption policies define the principles of internal cooperation, conduct in the working environment, and dealings with customers, suppliers, competitors, and other stakeholders. It provides employees, managers, and the Executive Committee with a framework for orientation and raises awareness of legal risks in everyday working life. All employees are regularly trained on the contents via web-based training courses and are required to comply with the principles set out therein. New employees are familiarized with the Code of Conduct during the onboarding process.

- Transition Assistance Programs: In Hinwil (Switzerland), courses are offered as preparation for retirement. Also, Belimo occasionally offers outplacement services in cases where the employer terminates the working relationship.

How Is Skill Development and Knowledge Management Measured?

The following tools are employed to decide which employees should receive training:

- Employee appraisal.

- Competency matrices for assembly workers.

- Career paths.

- Career development plans.

To gauge the success of our approach to skill development and knowledge management, the following key performance indicators are tracked:

- Average hours of training per employee.

- Number of leadership accelerator program alumni.

- Number of “Leadership by Personality” course alumni.

- Expenses for internal and external courses.

- Feedback forms collected after each training session.

- Employee survey results on the topics of skills development and knowledge management.

- Percentage of employees receiving regular performance and career development reviews.

- Percentage of employees who attended the web-based Code of Conduct training course.

To further strengthen the topic of skill development and knowledge management, a new global Head of Learning and Development was hired during the reporting period. In addition, the Company has continued to introduce new online and instructor-led programs to provide varied learning environments for employees. Belimo offers career path planning for managers and specialists and provides financial support for further individual education.

Equal Opportunity Employment

Why Is Equal Opportunity Employment Important?

Being a reliable partner that always bases its actions on the highest level of integrity requires cultural diversity, equal treatment for employees, and the prevention of discrimination. Belimo believes that the workforce should reflect the diversity of the population, as a variety of perspectives strengthens the Company’s knowledge base and offers a competitive advantage. In short: we believe that our success is only possible thanks to the diversity of our team and the inclusivity of our work culture.

What Is New in Equal Opportunity Employment in 2023?

At the management level – excluding the Executive Committee – the number of females increased by 17 to 18.9%. Belimo is currently developing a training program for managers to minimize bias in hiring and promotion processes. The proportion of women at the executive remained unchanged at 14.3% during the reporting period. At the board level, however, the number increased from 16.7% to 28.6% during the reporting period. In the future, the Company intends to further increase diversity at the board level where qualification is equal.

|

Diversity of Governance Bodies and Employees as at December 31 (Headcount) |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

All Employees |

|

|

|

|

|

|

|

|

|

Female |

|

37.1% |

|

38.8% |

|

38.2% |

|

37.2% |

|

Male |

|

62.9% |

|

61.2% |

|

61.8% |

|

62.8% |

|

|

|

|

|

|

|

|

|

|

|

Employees with Management Functions |

|

|

|

|

|

|

|

|

|

Female |

|

18.9% |

|

17.9% |

|

16.7% |

|

15.2% |

|

Male |

|

81.1% |

|

82.1% |

|

83.3% |

|

84.8% |

|

|

|

|

|

|

|

|

|

|

|

Executive Committee |

|

|

|

|

|

|

|

|

|

Female |

|

14.3% |

|

14.3% |

|

14.3% |

|

0.0% |

|

Male |

|

85.7% |

|

85.7% |

|

85.7% |

|

100.0% |

|

|

|

|

|

|

|

|

|

|

|

Board of Directors |

|

|

|

|

|

|

|

|

|

Female |

|

28.6% |

|

16.7% |

|

16.7% |

|

16.7% |

|

Male |

|

71.4% |

|

83.3% |

|

83.3% |

|

83.3% |

Belimo actively employs people with physical or mental disabilities, and is involved in various programs that help gainfully employ individuals with impairments. In 2023, 60 individuals with disabilities worked for Belimo under disability employment programs. Furthermore, a new pilot project was initiated with four employees of Werkheim Uster, an institution that supports people with cognitive disabilities. In the future, Belimo intends to increase employment opportunities for persons with disabilities.

|

Disability Employment Programs (Headcount) |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

Individuals with disabilities working for Belimo in the context of disability employment programs as at December 31 |

|

60 |

|

89 |

|

85 |

|

70 |

Belimo employees are encouraged to report breaches of our Code of Conduct through the globally accessible Belimo Integrity Channel. No case has been reported during the year under review.

How Is Equal Opportunity Employment Managed?

Belimo is committed to creating a work environment in which all individuals are treated with respect and dignity and are free from all forms of discrimination and harassment. The Company’s mission statement has been supplemented by a Code of Conduct that is the subject of a web-based training course, which all employees of Belimo are obliged to attend. Those expected to interact with customers and suppliers are also required to participate in an additional training course on the Company’s anti-bribery and anti-corruption policies.

How Is Equal Opportunity Employment Measured?

Belimo further improves its performance as an equal opportunity employer by tracking key performance indicators such as:

Number, type, and severity of cases reported through the Belimo Integrity Channel:

- Corruption, bribery, or conflicts of interest.

- Violations of free competition.

- Violations of environmental, health, and safety regulations.

- Violations of export or import regulations.

- Violations of Company rules and the Code of Conduct.

- Invoicing and balancing of accounts.

- Fraud, breach of trust, embezzlement, or theft.

Gender-related regulations and indicators:

- Compliance with the requirements of the Swiss Code of Best Practice for Corporate Governance with respect to gender benchmarks for the Board of Directors and Executive Committee of listed companies (percentage of women at the Executive Committee and Board of Directors level).

- Percentage of employees of each gender.

- Percentage of women in management positions.

- Percentage of women at Board of Directors level.

- Percentage of women at Executive Committee level.

Equal pay – equal work:

- The Company continually monitors its remuneration system to guarantee the principles of wage justice and competitive pay.

- Salaries and bonus payments are benchmarked against the market and adjusted as required.

- The internal remuneration system is screened for potential gender pay gaps, particularly during the annual salary adjustment process.

- The Swiss entities’ equal pay practices are evaluated using the official “Logib” tool of the Swiss Confederation.

Inclusion and diversity:

- The number of individuals with disabilities working for Belimo in the context of disability employment programs.