Credibility Culture

Remuneration Policy

General Principles

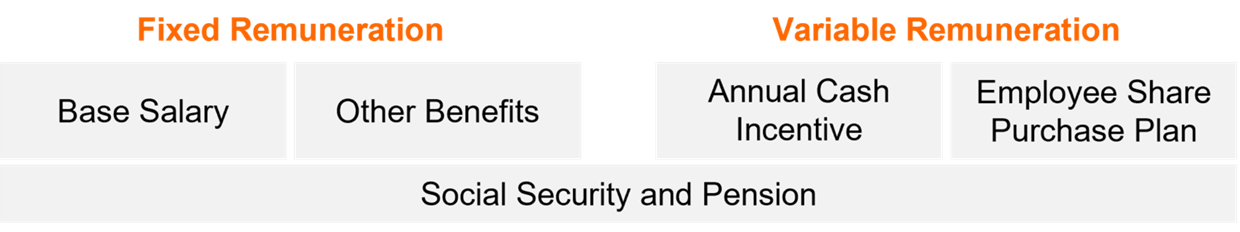

Belimo has established a transparent and long-term-oriented remuneration system. It ensures market-competitive and fair remuneration. All employees should feel valued for their work and benefit from the Company’s success. They receive a fixed base salary, and a variable remuneration, which consists of an annual cash bonus and, for our major subsidiaries, voluntary participation in the Employee Share Purchase Plan. The plan allows employees to purchase Company shares at preferential conditions and thus fosters the sense of ownership and the alignment with shareholders‘ interests.

Global Human Resources defines the minimum standards of employee remuneration throughout the Group. Together with regional and local Human Resources representatives, the managing directors of the subsidiaries are responsible for ensuring these requirements are met and that appropriate remuneration policies are implemented in accordance with local laws, regulations, cultures and market conditions.

Belimo is committed to internal wage justice and equal pay. To guarantee the principles of wage justice and competitive pay, Belimo continually monitors its remuneration system throughout the Company. A global job evaluation methodology is applied to ensure consistency, and remuneration is regularly benchmarked against the market practice. The internal remuneration system is screened for potential gender pay gaps. In 2021, Belimo evaluated its Swiss entities’ equal pay practices using the official “Logib” tool of the Swiss Confederation. This audited self-assessment identified no gender pay gap. In addition, the managing directors and Human Resources representatives of all subsidiaries are instructed to identify any gender pay gaps during the annual salary adjustment process.

Remuneration Benchmark Analysis

In the reporting year, the Remuneration and Nomination Committee conducted a review and a benchmark analysis of the remuneration structure and levels of the Board of Directors and the Executive Committee functions. The study was conducted by a remuneration expert team of PricewaterhouseCoopers (PwC). Prior to the study, it was ensured that there was no conflict of interest on the part of PwC. The peer group of 23 stock-listed Swiss companies depicted below was selected by Belimo:

|

Peer Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arbonia |

|

Daetwyler |

|

Huber + Suhner |

|

Schweiter |

|

Autoneum |

|

dormakaba |

|

Interroll |

|

Sonova |

|

BKW |

|

Forbo |

|

Kardex |

|

Starrag |

|

Bossard |

|

Geberit |

|

Komax |

|

VAT |

|

Bucher Industries |

|

Georg Fischer |

|

Landis + Gyr |

|

Zehnder |

|

Burckhardt Compression |

|

Gurit |

|

LEM |

|

|

With respect to the remuneration structure of the Board of Directors, the study showed that the remuneration for the Board Chair is below market, and the overall remuneration of the other Board members is in line with the market. It was decided not to change the remuneration levels and not to introduce additional committee fees, since responsibilities are evenly distributed among the Board members. Regarding the remuneration structure, Belimo is currently not fully aligned with the market as the Board of Directors’ fees are paid entirely in cash, while it is common to deliver part of the fees in company shares. Thus, the Remuneration and Nomination Committee proposed to adjust the payout model of the Board of Directors‘ fees. At the Annual General Meeting 2024, Belimo will request that the fees be partially paid out in shares, which will then be restricted for a period of three years. Board members will have the choice of receiving 20% to 40% of their fees in shares.

With respect to the remuneration of the Executive Committee, the benchmarking analysis showed that, while the remuneration mix (fixed versus variable remuneration) is generally in line with market practice, the structure of the variable remuneration slightly differs from market practice. Even though we do not provide a classic long-term incentive program, the Employee Share Purchase Plan provides for the necessary long-term and sustainable incentive needed to motivate and retain our key talent, including the members of the Executive Committee. It promotes the building up of significant shareholding positions of the Executive Committee in our Company. Our system follows a ten-year strategy cycle with fully aligned corresponding annual objectives. We believe that this better supports the long-term focus than complex systems that might foster short-term thinking.

In terms of remuneration levels, while the base salaries of the Executive Committee are within the market range for most functions, total remuneration was not fully aligned with market practice for all functions. Based on this result, the Board of Directors decided to adjust the total remuneration of the CEO and other functions to move closer to market standard.

Remuneration of the Board of Directors

To guarantee independence in executing their supervisory duties, the members of the Board of Directors receive a fixed remuneration that does not contain any performance-related component. The yearly fee amounts to gross CHF 254‘000 for the Chairman, and gross CHF 124‘000 for the other members of the Board of Directors. Each December, the fee is paid in cash for the current fiscal year.

Furthermore, Board members receive a flat-rate allowance for expenses. Additional fees for Board members who took on special tasks may be paid as well.

The remuneration of the Board of Directors is subject to regular social security contributions and is not pensionable.

Remuneration of the Executive Committee

The remuneration of the Executive Committee includes the following elements:

Fixed Remuneration

Base Salary

The base salary, paid in cash, is determined primarily based on the following factors:

- Market practice and competitiveness.

- Scope and complexity of the function.

- Profile of the individual (skills, experience of the individual in the function).

It is reviewed every year and may be adjusted considering market developments.

Other Benefits

Other benefits include the private use of a company car according to local tax law or annual travelcards for public transportation.

Variable Remuneration

The variable remuneration is designed to reward the achievement of business objectives of the Group and its divisions, as well as the fulfillment of individual performance targets as defined within the Management by Objectives process, over a time period of one year.

In total, 60% of the variable remuneration is linked to financial key performance indicators and 40% to non-financial business objectives.

Design of variable remuneration

|

Key Performance Indicator |

|

Purpose |

|

CEO |

|

Other members, Executive Committee |

|

|

|

|

|

|

|

|

|

Sales growth of the Belimo Group |

|

Measures Group sales growth |

|

30% |

|

15‒20% |

|

EBIT margin of the Belimo Group |

|

Measures Group profitability |

|

30% |

|

15‒20% |

|

Regional sales growth |

|

Measures regional sales growth |

|

0% |

|

0‒30% |

|

Cost ratio of the respective Group Division |

|

Measures the profitability of the respective Group Division |

|

0% |

|

10‒20% |

|

Inventory to sales ratio |

|

Measures efficient inventory management |

|

0% |

|

0‒10% |

|

Purchasing cost reduction |

|

Measures the reduction of manufacturing costs through value engineering |

|

0% |

|

0‒5% |

|

Financial business objectives |

|

|

|

60% |

|

60% |

|

|

|

|

|

|

|

|

|

Credibility culture |

|

Strengthens our culture of trust, integrity, competence, and responsibility |

|

16% |

|

16% |

|

Operational excellence |

|

Promotes reliable delivery of highest quality products |

|

8% |

|

8% |

|

Solution leadership |

|

Ensures innovation leadership in our markets |

|

8% |

|

8% |

|

Customer value |

|

Sharpens the focus on customer requirements for unique products and services |

|

8% |

|

8% |

|

Non-financial business objectives |

|

|

|

40% |

|

40% |

The financial key performance indicators include sales growth, EBIT margin (earnings before interest and taxes), regional sales growth, and cost ratio targets. The annual targets are derived during the yearly budget process, taking into account the long-term growth strategy objectives as well as the actual and the forecasted results for the current fiscal year.

Non-financial business objectives are set at the beginning of the year. They are closely linked to the Belimo value-creation model.

Each member of the Executive Committee is responsible for several objectives regarding those four values of Belimo. The objectives focus, for example, on project milestones, sustainability, product launches, engagement score, and operational improvements. They are generally cascaded in the organization to ensure a consistent focus of all employees on value creation for Belimo.

Up to 80% of the expected variable remuneration is paid out in December of the current fiscal year. The remaining portion is paid out in March of the following year, based on effective performance.

To align the interests of the Executive Committee with those of the shareholders of BELIMO Holding AG, the members of the Executive Committee are obliged to invest a certain percentage of the total variable remuneration in Belimo shares at preferential conditions via the Employee Share Purchase Plan. The minimal mandatory participation amounts to 40% of the variable remuneration amount paid out in December (which corresponds to 80% of the variable remuneration), with the option of voluntarily increasing participation to up to the entire amount of the variable remuneration paid out in December. This plan ensures a long-term commitment on the part of the Executive Committee in addition to a participation in the entrepreneurial risk.

Social Security and Pension

Pension benefits include primarily retirement and insurance plans that provide a reasonable level of income in case of retirement, death, and disability. The pension fund exceeds the minimum legal requirements of the Swiss Federal Law on Occupational Retirement, Survivors‘, and Disability Pension Plans (BVG) and is in line with commensurate market practice.

Remuneration Mixes and Caps

At target, the variable remuneration for the CEO is between 70% and 90% of the base salary:

|

|

|

|

|

Base salary |

|

Variable remuneration |

|

Total remuneration |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At target |

|

in % of base salary: |

|

|

100% |

|

|

87% |

to |

103% |

|

187% |

to |

203% |

|

|

|

in % of total remuneration: |

|

53% |

to |

49% |

|

47% |

to |

51% |

|

|

100% |

|

If the targets are exceeded, the overall variable remuneration for the CEO is capped at 120% of the fixed remuneration.

|

|

|

|

|

Base salary |

|

Variable remuneration |

|

Total remuneration |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum payout |

|

in % of base salary: |

|

|

100% |

|

|

|

120% |

|

|

|

220% |

|

|

|

|

in % of total remuneration: |

|

|

45% |

|

|

|

55% |

|

|

|

100% |

|

For the other members of the Executive Committee, the variable remuneration is between 40% and 70% of the base salary at target:

|

|

|

|

|

Base salary |

|

Variable remuneration |

|

Total remuneration |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At target |

|

in % of base salary: |

|

|

100% |

|

|

67% |

to |

91% |

|

167% |

to |

191% |

|

|

|

in % of total remuneration: |

|

60% |

to |

52% |

|

40% |

to |

48% |

|

|

100% |

|

If the targets are exceeded, the overall variable remuneration of the other members of the Executive Committee is capped at 100% of the fixed remuneration.

|

|

|

|

|

Base salary |

|

Variable remuneration |

|

Total remuneration |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum payout |

|

in % of base salary: |

|

|

100% |

|

|

|

100% |

|

|

|

200% |

|

|

|

|

in % of total remuneration: |

|

|

50% |

|

|

|

50% |

|

|

|

100% |

|

We are convinced that our remuneration plans as described above are designed to support a long-term and sustainable focus on the growth and success of Belimo.

Contractual Terms

All members of the Executive Committee have permanent employment contracts with notice periods of a maximum of twelve months. Members of the Executive Committee are not entitled to any severance or change of control payments. Non-competition clauses are not part of the employment contracts.